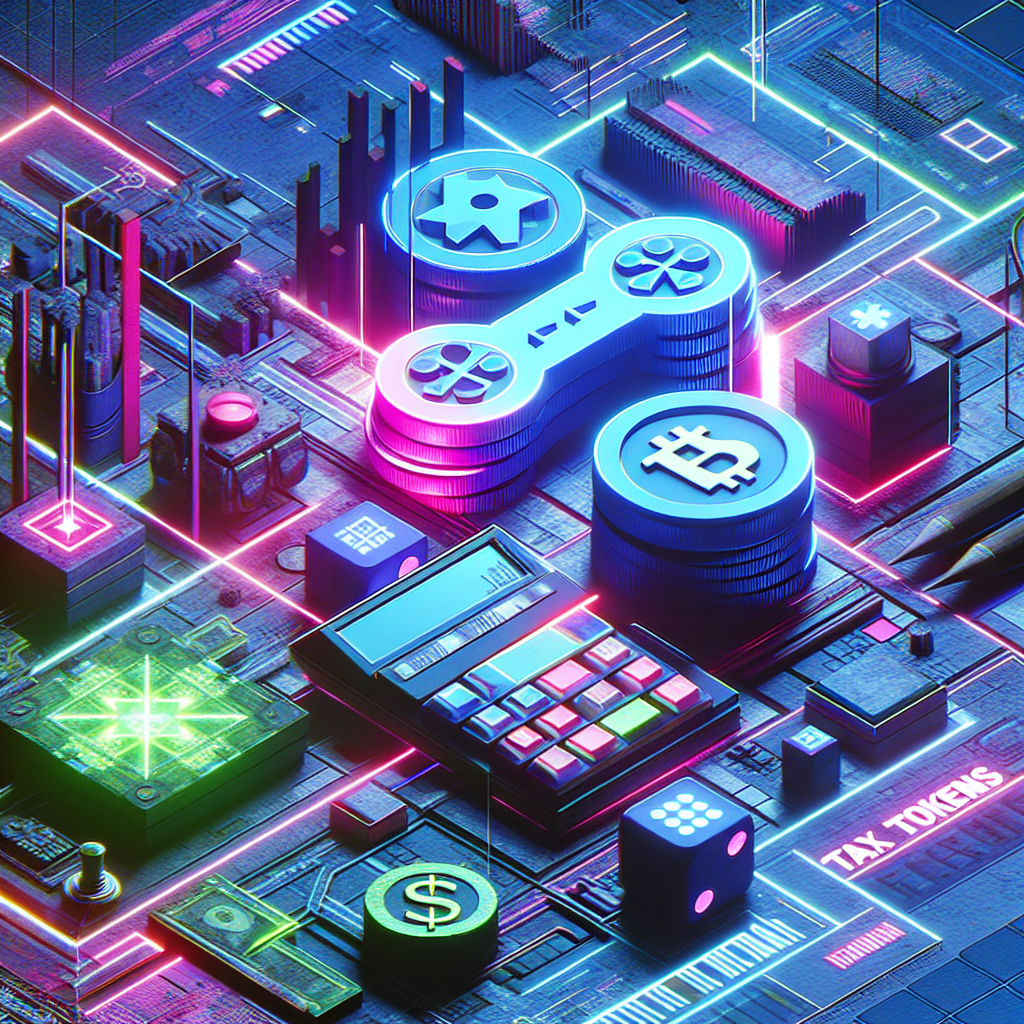

Tax Tokens: Common Designs and Real Projects

Explore Tax Tokens: Common Designs and Real Projects. Learn about how it works and practical cases in the crypto

Tax Tokens: Common Designs and Real Projects

Tax tokens have risen to prominence in the crypto ecosystem, becoming an integral part of many transactions. These tokens, which are taxed on each transaction, offer a variety of mechanics that affect both users and projects. In this article, we explore the most common tax token designs and concrete examples of projects that have implemented these structures.

Common Types of Tax Tokens

Within the universe of tax tokens, we find several structures that have gained popularity. Below, we describe the most outstanding designs:

- Classic Reflections: This model promises rewards for holders through a small cut on each transaction, redistributed among holders.

- Reflections on Stablecoin: Some projects choose to pay out rewards in stablecoins, which can give a sense of more stable dollar income.

- Liquidity/Cash Flow Routes: A portion of each transfer goes into a project liquidity or portfolio, which can be transparent or a “black box” depending on the project’s policy.

- Directional and Changeable Taxes: Some tokens are taxed based on the direction of the exchange (buy or sell), or have taxes that can be dynamically modified by the owner.

Tax Token Case Studies

Below are notable examples of tax tokens that have been implemented in the marketplace:

- Reflect Finance (RFI): This token applies a 1% tax on each transaction, automatically redistributed to holders, which set a standard in the design of reflections.

- Baby Doge Coin: A popular meme token that implemented a 10% tax, of which 5% is redistributed and the other 5% goes to liquidity, managing to capture a great deal of attention at its launch.

- EverGrow (EGC): This project applies a 14% tax, of which 8% is paid to holders in BUSD, demonstrating the effectiveness of stablecoin rewards.

- Floki and TokenFi: Some projects have reduced or eliminated their taxes after an analysis of their adoption and accessibility strategy, seeking to decrease friction for users.

Considerations for Evaluating Tax Tokens

When investing or participating in a project that uses tax tokens, it is crucial to take into account certain aspects:

- Transparency: Projects that break down how funds raised are used or have a clear path to modifying rates tend to build more trust.

- Commercial Activity: The viability of taxes often depends on the volume of transactions; An analysis of market activity can provide clarity on potential rewards.

- Adaptability: The best projects know when their tax mechanics need to be adjusted to foster sustainable growth.

Exploring tax tokens is critical to understanding today’s crypto ecosystem. Each design and project offers lessons on the dynamics of taxation in cryptocurrency trading, and understanding them allows investors to make informed decisions.

For more information on this topic, you can visit the original article on STON.fi.

Note: This original content has been modified with AI and reviewed by a specialist.