Institutional Cases at TON: New Financial Infrastructure

Explore Institutional TON Cases Transforming Financial Infrastructure. Find out how they drive innovation and efficiency. 👉 Click Here.

Institutional Cases at TON: New Financial Infrastructure

The TON (The Open Network) blockchain is revolutionizing the financial infrastructure landscape through various applications in the institutional arena. As organizations stop exploring blockchain technology in theory and begin to implement it in practice, TON is positioning itself as a prominent choice for businesses and fintechs looking for scalability, efficiency, and seamless integration with their current operations.

Stablecoin Issuance and Payments: USDT in TON

The launch of USDt in TON in April 2024 marked a significant milestone. By the end of 2024, the authorized issuance had exceeded $1.43 billion, positioning TON among the top five blockchains in terms of USDt activity. Institutions use USDt in TON to:

- International remittances: Fast dollar transfers at minimal cost.

- Merchant and treasury operations: Instant settlement with global reach.

- Retail integration: Frictionless access through native Telegram wallets like Wallet on Telegram, Tonkeeper, and MyTonWallet.

USDt acts as a fully accessible digital payment channel that connects businesses with hundreds of millions of Telegram users, reducing latency in payments and operational risk.

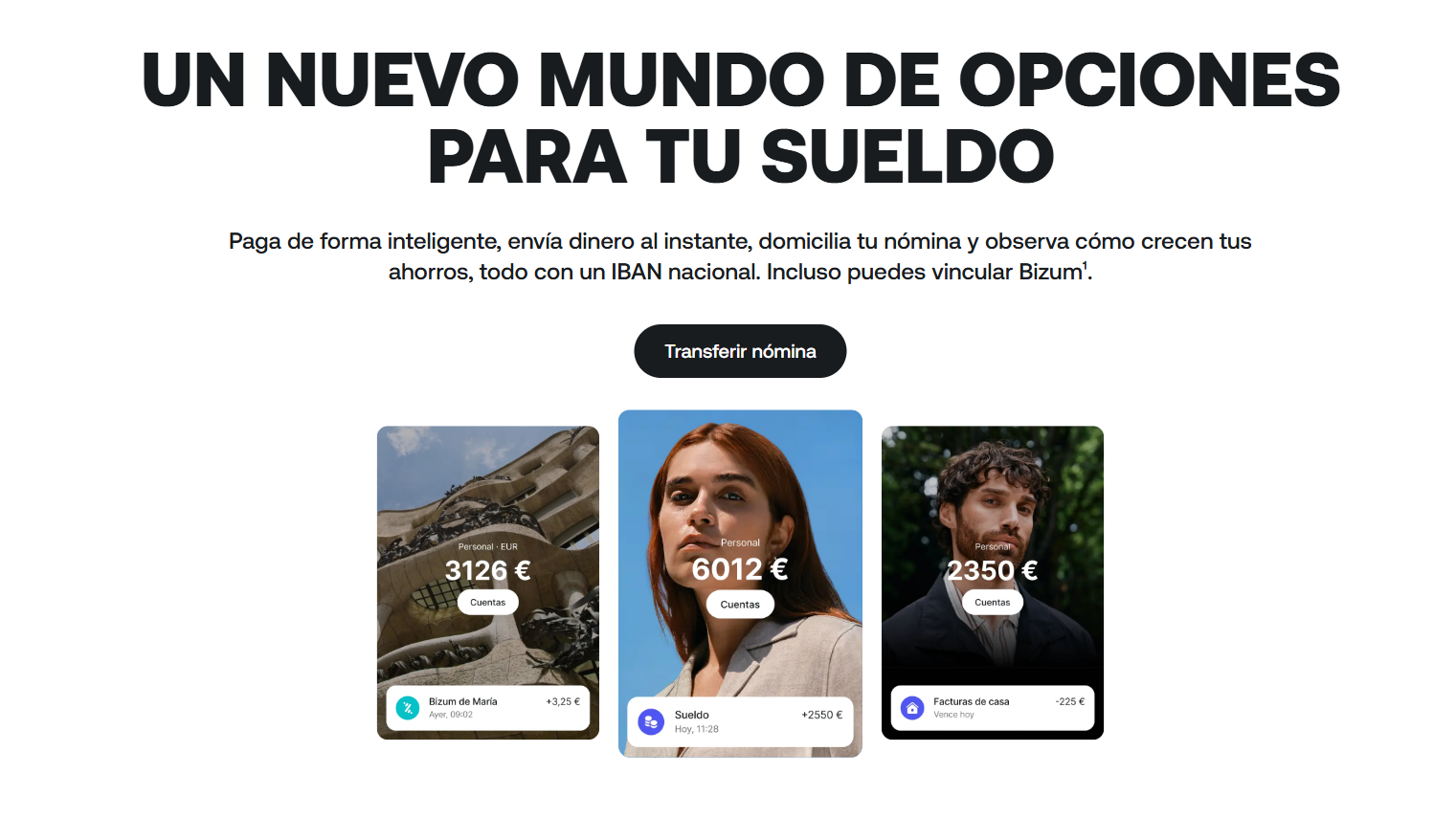

Built-in Finance and Tokenization Within Telegram

TON allows financial products to be where users already are: within the messaging platform. Businesses can issue and manage digital assets natively on Telegram, eliminating the need for external registrations or new app downloads. With TON Wallet, users can send funds using just a Telegram username. This model provides a multitude of applications, including:

- Tokenized loyalty programs and tipping systems.

- Subscriptions and in-app commerce.

- Microeconomies driven by tokens and creator monetization.

DeFi and Institutional Treasury Solutions

TON’s DeFi ecosystem has matured rapidly, providing a suitable environment for institutional-level liquidity management. Platforms such as STON.fi and DeDust facilitate swaps, liquidity pools, and yield products on stablecoins, ensuring transparent and auditable on-chain settlement. Through the use of DeFi TON, businesses can:

- Implement corporate reserves in stablecoin liquidity pools.

- Generate short-term returns on idle capital.

- Support initial liquidity for native TON projects.

Stablecoins That Generate Yield: USDE and TSUSDE by Ethena

The integration of Ethena’s synthetic USDe and tsUSDe instruments in April 2025 added a new dimension to TON’s institutional tools. These instruments offer return without market volatility through a delta-neutral hedging strategy. In practical terms, tsUSDe functions as a tokenized money market fund:

- Chain treasury management.

- Payment channels that generate performance.

- Low-risk institutional exposure to DeFi.

Institutional Readiness: Compliance, Stewardship, and Scaling

For institutional adoption, regulatory compliance and operational assurance are as important as performance. TON’s architecture provides:

- Transparent and auditable records for settlement verification.

- Custody integrations with regulated service providers.

- Native KYC and access control options for the issuance of compliant assets.

- Cross-chain compatibility, ensuring interoperability with stablecoins and Ethereum-based custody systems.

With sub-second completion and ultra-low fees, these capabilities make TON an ideal platform for regulated fintechs, payments firms, and asset managers entering Web3.

TON is leading the change in institutional adoption of blockchain technology, offering businesses the opportunity to build innovative and efficient financial applications. With more than a billion users within reach of a message, the next wave of institutional innovation is already taking shape at TON.

Source: TON Blog

Note: This original content has been modified with AI and reviewed by a specialist.